The F-rank and T-rank algorithms are innovative methods of stock analysis that work based on relative comparisons of company metrics. Unlike traditional analysis methods, F-rank and T-rank do not provide absolute values.

When analyzing two companies using F-rank or T-rank, it is important to note that the algorithm does not determine which company is better based solely on the number of points it receives. Instead, the correct interpretation is that the company with a higher score is more attractive for investment purposes, considering its fundamental or technical indicators, respectively. The outcome depends on the specific companies being compared. For example, if you compare two large and reliable companies, the algorithm can help you decide which one to invest in. On the other hand, if you input data for two underperforming companies, F-rank will identify the better option for value investing, while T-rank will indicate the more oversold company.

To evaluate more than two companies and select the best one, you can use F-rank and T-rank as follows: divide your four companies into two groups of two and input each group into F-rank or T-rank. This will give you the leaders in each group. Then, input the two winners into F-rank or T-rank again to find the ultimate winner among them. By following this simple manipulation, you can identify the best company from a larger pool of options.

So, how does F-rank determine the best company? F-rank seeks undervalued companies by considering factors such as business efficiency relative to the cost of the business in relation to the balance sheet value of the company. It evaluates the potential growth of a company's stock price and its potential profit growth within a specific timeframe, while maintaining fundamental indicators at the company's valuation level. Additionally, it assesses sales growth rates over recent years in relation to the company's size and profitability. This approach takes into account the fact that smaller companies have an easier time doubling their size compared to larger companies.

F-rank utilizes a 300-point system, distributing these points between the two companies being compared. It is important to note that F-rank does not analyze companies with negative values for metrics such as ROE, EPS next Y, profit margin, and sales past 5Y. The algorithm is not designed to evaluate companies with negative values in relative comparisons, as such comparisons are not valid. It is advisable for investors to avoid analyzing and investing in such companies. You can use a screener tool in financial visualization platforms to filter out companies with positive values for these metrics. There are over 1200 such companies available for analysis. Therefore, the F-rank algorithm has a restriction on entering "-" (minus) symbols in input fields. Choose companies that operate with positive values, rather than negative ones. You can set additional criteria for companies using the screener tool to narrow down your search from thousands to around 10 or 20 companies.

Similarly, the T-rank algorithm also uses a 300-point system as its foundation, but it allows for negative values in technical analysis. Other than that, T-rank operates similarly to F-rank.

In conclusion, the F-rank and T-rank algorithms provide innovative and comprehensive tools for stock analysis based on relative comparisons of company metrics. These algorithms can assist investors in making informed investment decisions by identifying undervalued companies and oversold stocks. Our platform offers free access to these algorithms without any hidden fees or advertisements, allowing a wide range of investors to benefit from these valuable tools without limitations. We would like to express our gratitude to the creators of CHAT GPT for their contribution in developing our platform.

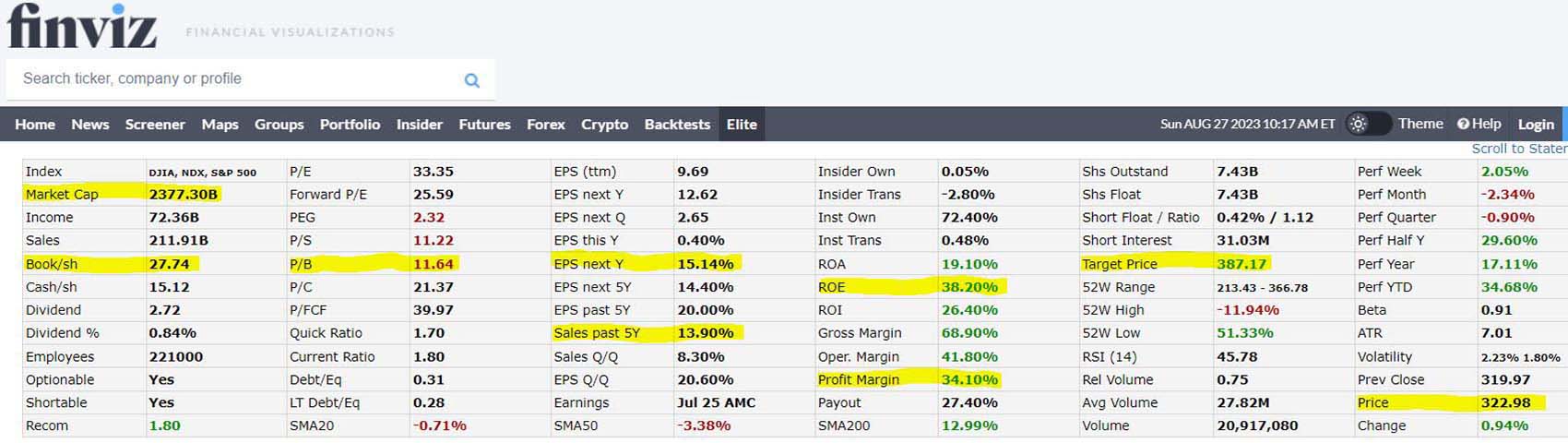

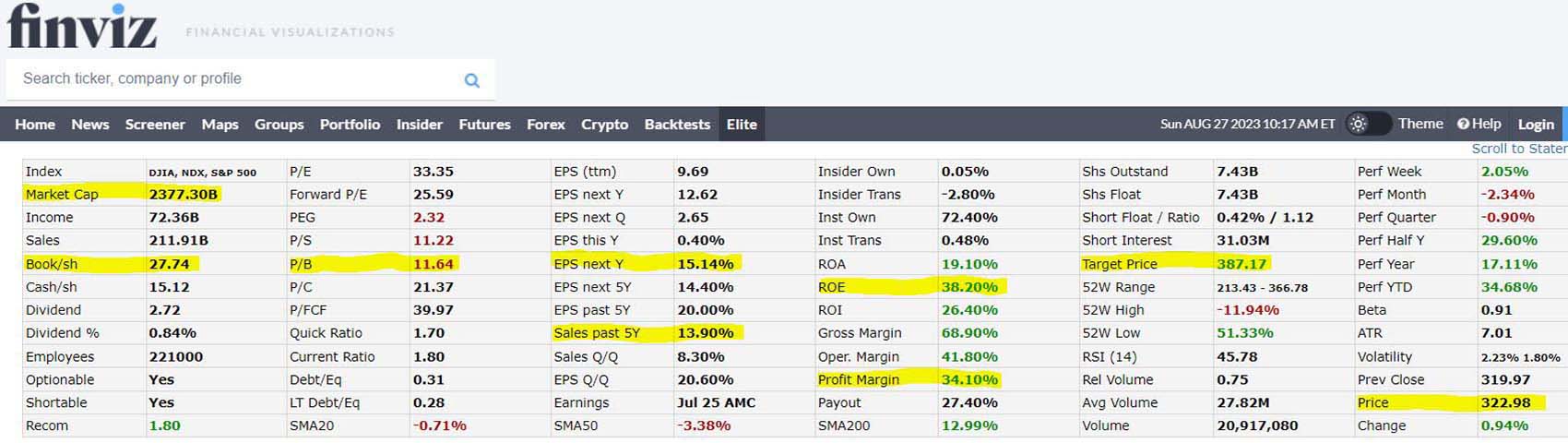

Where:

Market Cap - company's market

capitalization

Book/sh - book value

per share

P/B - ratio of a company's

market capitalization to its book value of assets

EPS next Y - estimated long-term annual

earnings per share growth for the next 5 years. Expressed in %

Sales past 5Y - annual sales growth

over the past 5 years, in %

ROE -

return on equity, ratio of net income to shareholders' equity

Profit Margin - percentage of sales

revenue that the business retains after deducting all expenses

Target Price - stock price growth

potential

Price - current market

price per share of the company

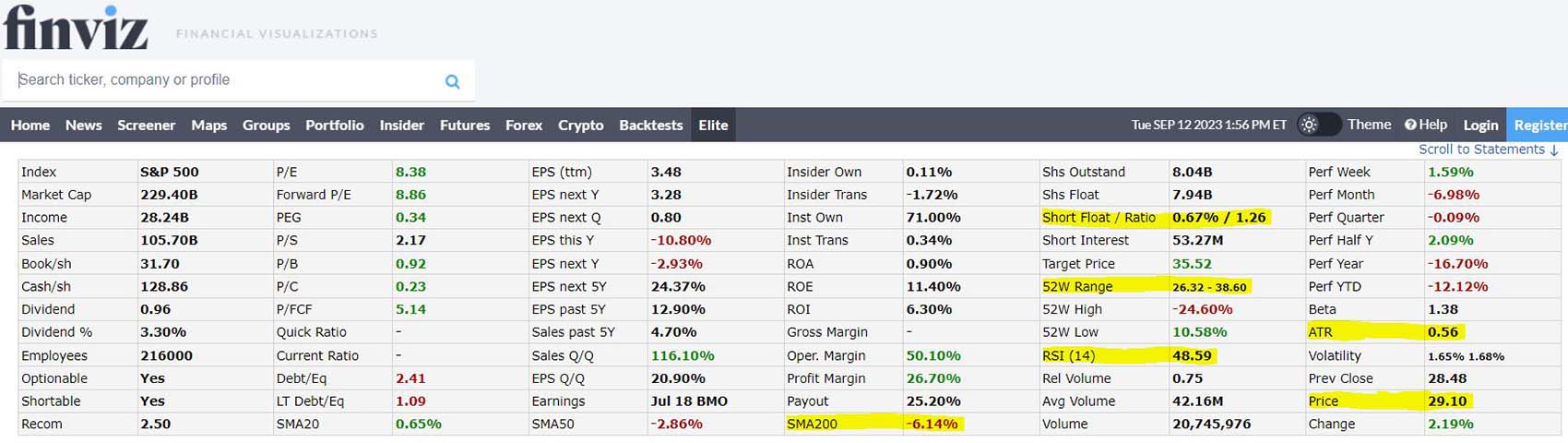

Where:

SMA200 -

distance from 200-Day Simple Moving Average

Short Float/Ratio - short interest share / ratio

52W Range

- minimum and maximum prices over the past 52 weeks

RSI (14) - relative strength index

ATR

- average true range (14)

Price

- current market price per share of the company

Share our service on your social networks: